Sometimes I really feel like people are incapable of thinking for themselves… Let’s take a home loan for example.

It’s widely known that you can write off the interest of the loan (not the principal) in your income taxes. Soon I’ll be building a house, and everyone keeps telling me that I should get a loan so I can write off the interest. Okay, that’s nice… but why not just pay for it outright I ask them? Their response is always, “Because then you can’t write off the interest.”

So if people would stop repeating what other people say and actually think about it, they might not think that way. Let’s do the math here… A 30 year loan for $1,000,000 at 7% interest would be $6,653.02 per month. That means you have paid $2,395,087.20 over the course of the loan (roughly $1.4M in interest). Wow, that’s fantastic, eh? Now you can write off $1.4M that you paid out that you otherwise could have simply kept. Which at a 30% tax bracket would be a savings of $420,000 because of your write off.

Hmmmm… pay $1,395,087.20 so you can get back (“save”) $418,526.16. What a deal!

It is a good thing, but if you can pay cash, that’s better… it’s funny to see people argue that you should “keep” your money rather than pay off your loan so that you can have the tax “break”.

If you are reading this, and you think it’s a good idea, maybe you should shop around for the highest interest rate you can find, because then you get a bigger tax write off. 🙂

Harry Whittington, a 78-year-old lawyer, was shot by our vice president, Dick Cheney over the weekend while Cheney was quail hunting.

Harry Whittington, a 78-year-old lawyer, was shot by our vice president, Dick Cheney over the weekend while Cheney was quail hunting.

Sometimes I forget about how god damn sexy I am.

Sometimes I forget about how god damn sexy I am. I know it’s in terribly bad taste to make fun of someone’s blog (especially since this one sucks), but when someone starts

I know it’s in terribly bad taste to make fun of someone’s blog (especially since this one sucks), but when someone starts  I wonder if Osama bin Laden is super stoked about one of his “blood” posing for racy pictures in GQ magazine…

I wonder if Osama bin Laden is super stoked about one of his “blood” posing for racy pictures in GQ magazine… So I’m sitting here working, minding my own business, when I happened to hear the roar of a jet engine somewhere close. So make the huge trouble (hehe) of turning my head to look out my window, and two Stealth Fighters were cruising by (maybe 500 feet off the ground). Obviously they just took off from the

So I’m sitting here working, minding my own business, when I happened to hear the roar of a jet engine somewhere close. So make the huge trouble (hehe) of turning my head to look out my window, and two Stealth Fighters were cruising by (maybe 500 feet off the ground). Obviously they just took off from the

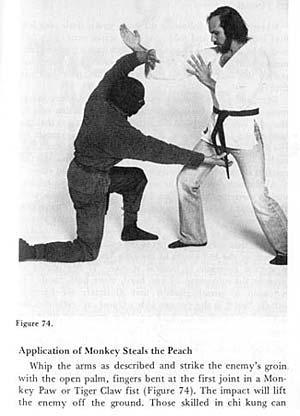

As many of you know, I’m in the middle of fulfilling my childhood dream of becoming a ninja. At this stage of training, it’s just a lot of book work, but hopefully someday it will be all worth it.

As many of you know, I’m in the middle of fulfilling my childhood dream of becoming a ninja. At this stage of training, it’s just a lot of book work, but hopefully someday it will be all worth it.